Mastering Cost Risk with the CRED Model: A New Approach to Managing Uncertainty

Planning and Progress: Estimation Challenges Facing U.S. Teams

Trusted by leaders in the industry:

Trusted by leaders in the industry:

Cost estimation in the United States presents a sharp contrast between perception and outcomes. According to Galorath’s 2025 Industry Report on Cost, Schedule, and Risk, 78% of U.S. professionals report moderate to high confidence in their estimates. However, 51% of projects exceed budget targets, and nearly half miss key milestones.

This gap between planning and execution appears consistent across multiple indicators. While the U.S. leads in areas such as alignment tracking and interest in automation, it also reports elevated levels of tool fragmentation and miscommunication between teams. Compared to peers in Japan, Canada, and parts of Europe, the U.S. demonstrates higher urgency but slower progress in integrating estimation with broader delivery systems.

Improving data quality, connecting estimation to delivery workflows, and expanding cross-functional training represent key areas of opportunity. As cost pressure grows and forecast accuracy becomes more critical, addressing these challenges could support more reliable, consistent outcomes over time.

Confidence

0%

Somewhat confident

0%

Very confident

Outcomes

0%

Projects over budget

0%

Projects missing timelines

The survey gathered perspectives from 180 senior and mid-level professionals across industries where cost, schedule, and risk estimation are mission critical. Participants were recruited through a custom process and verified through multi-layer identity authentication to ensure subject matter expertise. Each respondent completed the survey via a unique, single-use link with strict quality controls, fraud detection, and response validation protocols. This approach provides a reliable, third-party–verified view of how organizations are approaching project planning in today’s volatile environment.

Perception Outpaces Performance in the U.S. and Abroad

Confidence in cost estimation remains strong in the United States. More than half of U.S. respondents (54%) describe themselves as “somewhat confident” in their estimation process. But that sentiment doesn't always align with performance: 52% say projects go over budget occasionally, and 46% report frequent timeline misses.

This pattern holds globally. In Japan, 60% express moderate confidence, yet 100% report budget overruns. APAC respondents show a similar disconnect, with 66% confident but only 33% reporting frequent overruns. Canada reports stronger confidence with fewer overruns, while Europe is split: 21% are “very confident,” but the UK trails with just 7% expressing high confidence.

These figures reveal a consistent gap between perceived and actual estimation effectiveness:

High Interest, Low Implementation Across All Regions

Automation is a clear priority, but few teams in the U.S. have moved beyond the early stages. Fewer than 5% have automated more than three-quarters of their estimates, and nearly 70% want automation to handle repetitive tasks and integrate real-time data.

This gap between intent and execution is not unique. Other regions show similarly low maturity, with Europe and the UK ahead, and Japan and APAC still largely reliant on manual methods.

Key barriers include:

Fragmented tools and workflows

Limited access to real-time data

Low internal confidence in outcomes

Lack of pilot programs to demonstrate value

To move forward, organizations should begin with low-risk automation pilots. Targeting repetitive tasks or early-stage estimates can reduce manual effort, improve consistency, and build confidence across teams.

Top Automation Features Desired

0%

Automation of repetitive tasks

0%

Real-time data integration

0%

Enhanced reporting/visualization

Integration Challenges Undermine Accuracy and Agility

Estimation processes are still fragmented across departments. In the United States, 52% of teams say their workflows are only partially integrated. Globally, the picture is similar. Most respondents report incomplete integration between functions such as engineering, finance, and procurement. The result is limited visibility, inconsistent assumptions, and slow response to change.

Even when estimates are technically sound, they often fail to reflect real-time shifts in project scope or delivery constraints. Disconnected systems prevent organizations from sharing data efficiently or aligning across teams, which increases risk and weakens planning confidence.

Key barriers to integration include:

Siloed cost, schedule, and resource planning tools

Inconsistent processes for data handoffs and updates

Poor alignment between historical data and current forecasts

Limited collaboration between engineering, finance, and operations

While some regions, such as Canada and parts of Europe, report more progress, most organizations still struggle to connect estimation with broader delivery systems. To improve project outcomes, U.S. teams must prioritize cross-functional alignment. Integrated systems reduce delays, surface hidden risks, and improve forecast quality across the project lifecycle.

0%

Partial integration

Common across

all regions

0%

Full integration

Canada leads with

42% fully integrated

Common barriers

Siloed tools, misaligned inputs, poor data sharing.

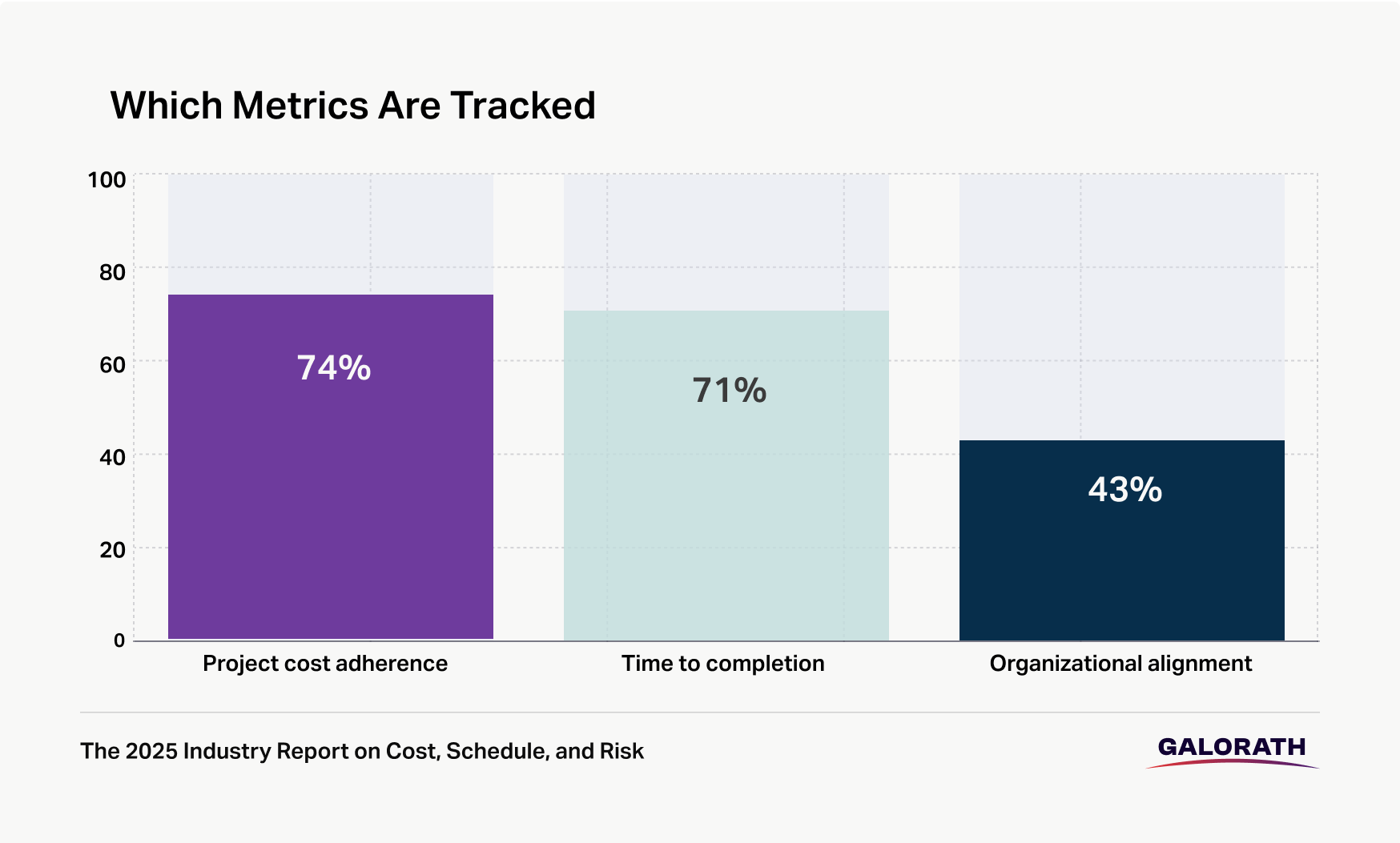

Most Teams Track Cost and Time but Overlook Alignment

Most U.S. organizations measure budget and schedule performance, but far fewer track how well teams align across functions. Data from the 2025 industry study shows that 73% of U.S. respondents monitor cost adherence and 71% track timelines. Only 43 percent include cross-functional or organizational alignment in their success metrics.

This gap limits visibility into disconnects between planning and execution. Alignment is especially important in projects that require coordination across engineering, finance, procurement, and leadership teams.

Globally, alignment tracking is even less common. In Canada, just 33% of organizations measure it. Most other regions fall below 20%. Europe and the United Kingdom report the lowest usage, with fewer than 5% of teams including alignment in their project evaluations.

By prioritizing alignment, organizations can move from reactive tracking to more proactive management. Shared dashboards that connect business goals to project delivery can improve coordination, reduce rework, and support more strategic execution.

Cost Tracking

0%

Time tracking

0%

Alignment tracking

0%

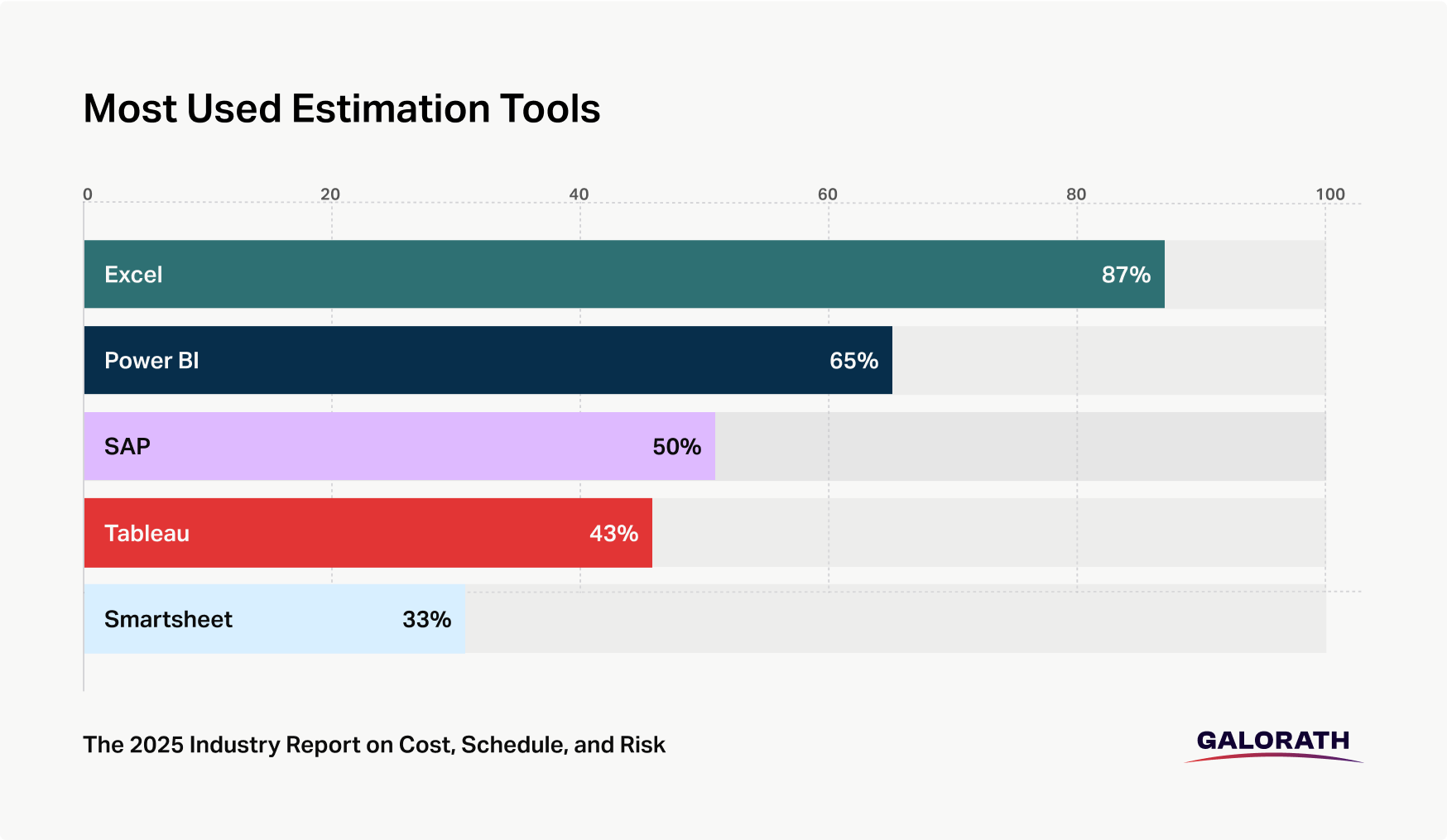

Standardization Gaps Undermine Estimation Effectiveness

U.S. teams have access to a wide range of estimation tools, but few use them in consistent or coordinated ways. Eight seven percent of U.S. respondents rely on Excel, and most teams juggle four to six different tools. However, these tools are often used without shared standards or cross-team workflows.

The bigger issue is training. Nearly one-third of U.S. professionals say the lack of formal training limits their ability to improve outcomes. Many learn estimation practices informally, which leads to inconsistent execution, uneven accuracy, and limited scalability.

This challenge is not unique to the U.S. Excel dominates globally, but countries like Japan and the United Kingdom show broader tool adoption. Even so, most regions report similar training gaps and process fragmentation.

To close these gaps, organizations should invest in internal training frameworks, including estimation playbooks, peer-reviewed templates, and role-based certification programs. These steps can improve consistency and build lasting capability across teams.

0%

Excel usage

0%

Formal training cited as a barrier

Common barriers

Teams rely on 4–6 tools to get work done

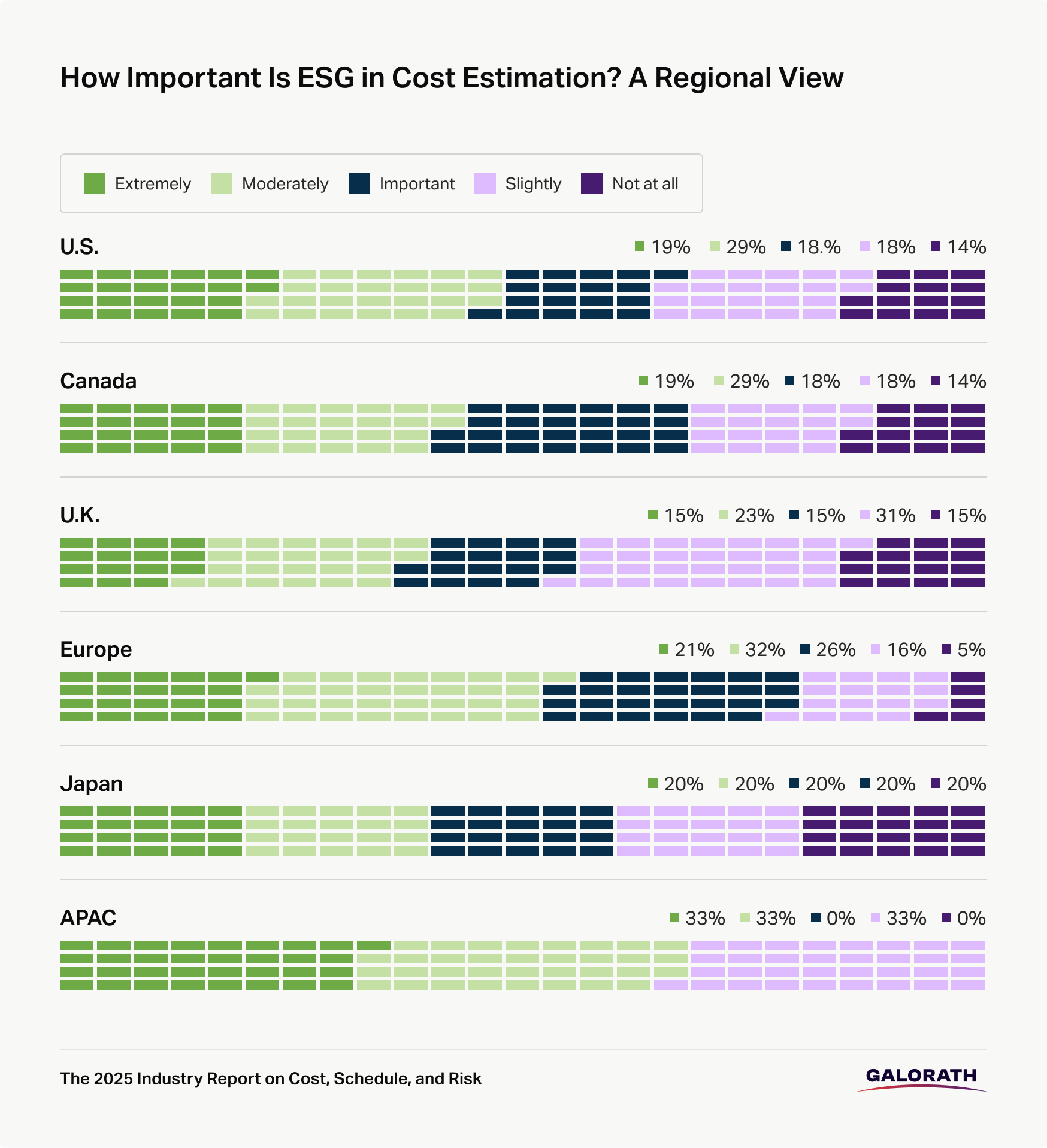

Few U.S. Teams Prioritize Sustainability or Compliance in Cost Planning

Despite growing pressure from investors and regulators, most U.S. organizations have not integrated environmental, social, and governance (ESG) factors into their estimation frameworks. Only 19% of U.S. respondents consider ESG to be “extremely important,” and just 33% say regulations meaningfully shape their cost models.

This disconnect between boardroom priorities and frontline execution creates risk, especially for companies operating internationally or under emerging compliance mandates. As expectations around disclosure and accountability increase, so does the need for estimation practices that account for ESG inputs and regulatory impacts.

While some global peers are moving faster, the takeaway for U.S. teams is clear. Building ESG into cost estimation early can help organizations anticipate costs, meet compliance requirements, and support long-term planning.

0%

ESG rated

“extremely important”

0%

Regulations shape

cost frameworks

Key Roles Are Driving the Shift from Technical Practice to Strategic Capability

Survey data highlights how estimation maturity is being shaped by role-specific focus areas. While gaps remain, several trends suggest where U.S. organizations are concentrating their efforts.

This report is part of a deeper look at how cost, schedule, and risk planning are evolving. Access the full 2025 Industry Report on Cost, Schedule, and Risk to see where the biggest gaps and opportunities exist.

Access The ReportAccess the infographic to keep the most important data points from the report on hand.

Download Infographic